Some of us might always be thinking to earn more and more. Better lifestyle and luxury are always irresistible things to avoid. Have you ever thought of earning money by saving it? No matter if you are undergoing economic strains under this turbulent economy and trying to cut off areas of expenditure or you are simply trying to save more for a steady future, some easy action could help you getting your desired aim.

Here comes some tips, relying on which you could save more.

1) Stop buying new things unless you really need it. Stay away from the luring advertisements which could create the hype in you and thereby compelling you to buy the latest trendy mobile handset. This is applicable for every such thing. Think many times before buying it and ask yourself “do I need that?” When you have to buy it, go for the best price available. Try looking up through the net. This way you will retain yourself from spending a lot of money.

2) Stop eating out a lot. Try to save money by having food from home. Keep away from expansive coffee shops or ice-cream parlor. We never realize how much money we can save by looking up these little things.

3) Some services need to be reconsidered if you are keen on saving. Think about your land phone, postpaid mobile bill, expanded cable connection etc. By managing such things you will end up putting aside around 100 bucks.

4) For sometimes stop buying cloths frequently. Many of us have weakness for dresses and other accessories. But if you can manage us to seldom buy cloths, it is going to help us in many ways. Even though we need to buy, try some special discount rates or second hand cloths stores. Often big branded cloths are available there. All you need is to keep your eyes open.

5) The most important thing is to make a budget. If you can then make a list of your monthly or weekly expanses that includes food, gas, phone bill, electric bill etc. Then calculate the areas. This is the best thing which serves limiting your expanses and saving money for you.

Try following this and don’t give up initially if it appears hard to follow. Take some time and be patient with this strategy. You will surely going to succeed if some of plans are implemented thoroughly.

About Me

- Jason

- Lets share all the happenings in the town and also our knowledge on finance and insurance to make us finance smart. For any kind of Financial advice don't forget to call me.

For Advertising and financial Queries

Categories

- Credit (6)

- Personal Finance (6)

- Insurance (3)

- Mortgage (3)

- 401k (2)

- Budget (2)

- Debt (2)

- Financial Advice (2)

- Money (2)

- News (2)

- Recent News (2)

- Recession (2)

- Billionaire (1)

- Finance News (1)

- First Bank of Jacksonville in Jacksonville (1)

- Fla (1)

- Fun (1)

- Job Bill (1)

- Obama (1)

- Recent Polls (1)

- Tax (1)

- Video (1)

- bankruptcy (1)

Blog Archive

-

▼

2009

(23)

-

►

August

(8)

- HOW TO LOWER THE COST OF YOUR HOME INSURANCE: GET ...

- HOME-INSURANCE : FOR TENANTS

- SIMPLEST WAY TO BOOST CREDIT SCORE: USE YOUR CREDI...

- HOW TO SAVE FOR A RAINY DAY: PERSONAL FINANCE GIVE...

- How And When To Refinance A Mortgage: Rule Of Thumb

- The Credit Correction and Bad Credit

- Credit Card Debt Consolidation: Some Basic Facts

- Best Strategies to Control you Finances

-

►

August

(8)

Links

Wednesday, December 16, 2009

Make Money by saving it: 5 easy ways

Posted by

Jason

at

9:09 AM

5

comments

![]()

Thursday, December 10, 2009

Financial advice 401k loan

Many people seek "Financial advice on 401k loan" but very few gets the right advice. It is very much important to have right advice on this big matter for the people who are interested in managing their finance especially in retirement savings.

Many people seek "Financial advice on 401k loan" but very few gets the right advice. It is very much important to have right advice on this big matter for the people who are interested in managing their finance especially in retirement savings.In general 401K loan taken from the 401k saving and it comes with many facilities. First of all, it lets you get money from 401 savings. Secondly, it is the loan where you are to get more tax advantages after your retirement.

Another aspect of this loan is tempting enough in making it more popular among other interest plans. Often many financial counselors give advice in getting money on 401k loan plan but the key concern is that it will not be shown on your credit report. Lets know some financial advice 401k loan to understand 401K loan better.

Some Advices:

Borrowing money in 401k plan should be done only if you have no other option.

Till you pay the loan, you will be having the same advantage of your 401k’s tax increase. It will naturally reduce the amount at the time of your retirement.

You have to pay the loan within 5 years. If you are unable to do so, it will be taken as a distribution and you have to pay the income tax while at the same time paying an fine (in case you are under 59)

As there is no fee for having a loan of from a 401k plan, many jump to it. But one should understand that this plan will cost more to repay the loan as loan payments should be done with after-tax dollars.

Some Advantages:-

1) It will have no credit checking and be sure of getting the loan.

2) Low interest rate

3) 401k loan is very handy. It is sometimes a phone call away while others need documenting.

4) It is tax-free. There is tax in the interest. Only when you retire, you have to think about it.

Some Disadvantages:-

1) In the 401K One actually doesn’t borrow money from others but invest his own.

2) One loses the interests. Ultimately one has a smaller amount to invest and to receive interest. Keep in mind that you are not actually borrowing money but using your own account (savings etc.) to repay the loan that you acquired from 401k plan.

3) It is not tax-free now. At the time of retirement you’ll have to pay taxes again. So consider it before taking it and it is also conceived as a consumer loan.

4) Until you pay the loan, it is considered as rash distribution. State and federal taxes are after you if you are under 59 and half.

The 401k loan is a convenient and fast way of getting loan using your retirement savings. After going through this article (Financial advice 401k loan) you must have a better insight into the plan. It is best option when you are facing financial crisis and you are left with only this option. You can also checkout investment advice on 401K.

Tired with all the tips, now checkout the funny video Hitler upset on His 401 K Statement

Posted by

Jason

at

10:59 PM

1 comments

![]()

Labels: 401k, Financial Advice, Personal Finance

Tuesday, October 27, 2009

Cut the Spending by Hundreds of Dollar

Our economy is still not fine. In this bleak economy if you can save a dollar, can let you float one more day. I have found such a post which can help you a lot of money which can fuel your family expenses.

You can find some ideas which can help us a lot. The ideas are unique and really can make difference in your grocery and car bill.

Read More...

Posted by

Jason

at

10:12 AM

0

comments

![]()

Labels: Budget

Friday, October 9, 2009

Obama won the Nobel Peace prize for the Year 2009

US President Barack Obama has been awarded Nobel Peace prize for the year 2009 for his great efforts establishing international brethren, international diplomacy and the peace process. The Nobel Commitee spotted Obama's outstanding job for promoting nuclear proliferation and international brotherhood. This year there were 205 nominations for this peace award but at last Barack Obama has beat all others and bags this prestigious award.

The winner will get a gold medal, $1.4m and a diploma from the committee. The Norwegian committee rightly expressed that it is very rare to find such man like Obama who have captured the whole word's attention and also fulfilling every one's dreams.

Posted by

Jason

at

2:40 AM

1 comments

![]()

Labels: Obama

Tuesday, October 6, 2009

Debt Management: 3 Suggestions

Often you are confused seeking advices from experts. HOW to manage debts, that are increasing your headache. Here are three simple ways to control your finance concerning debts.

CHALK-OUT YOUR BUDGET

Make a list of your essential operating costs (including credit, car rental, groceries, and house). Then estimate the balance. Make the half to pay your debt and other half to save in the bank. In this way you will in no time cut down your due amount. Keep in mind that you are at the same time saving money.

REDUCE YOUR NUMBER OF CREDIT CARDS

When you are suffering from the huge credit balance, why don’t you simply leave out some of your credit cards? See out the companies, with whom you have the least amount of debts. Go to them and pay your bill and most importantly cancel them. This will decrease your tendency of spending a lot on these cards.

SEEK FOR DEBT MANAGEMENT BUSINESS ORGANIZATION

If none of these two ways are unable to help you out, why don’t you go for the specialist debt management officials. They will give you good counseling and provide you with several other ways to pay the debt. According to your amount, they will offer you to pay in monthly installments. There are companies who are acquainted with creditors. Thus who knows they might save your interest as well.

These are some advices that I could give you in matter of high debts. Go and chose whatever option suits you well.

Posted by

Jason

at

11:52 PM

1 comments

![]()

Monday, September 21, 2009

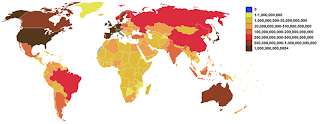

What country has the highest external national debt?

Today I got this interesting question "Which country has the highest external national debt?" in a quiz show and was eager to know the answer. I tried by every means and got various interesting data charts. My expectation was that the answer must be some third world country or some developing nation. But when I got the real answer, it left me awe struck. According to the facts our own country, the world super power USA is the country with the highest external national debt. Can you believe it?

Today I got this interesting question "Which country has the highest external national debt?" in a quiz show and was eager to know the answer. I tried by every means and got various interesting data charts. My expectation was that the answer must be some third world country or some developing nation. But when I got the real answer, it left me awe struck. According to the facts our own country, the world super power USA is the country with the highest external national debt. Can you believe it?

Before going into the facts, we must know what is meant by external national debt? Does external debt is what the country lends from other countries? No, the external debt consists of public and private debt that has to be paid through foreign currency or the services and goods to other country or other country nationals or even to non residents.

According to the The World Factbook, USA has a debt of $13,773,000 to the external entities. This means our external debt is 95% of our total GDP. UK is coming close second with $12,670,000 with 375% of its national GDP. The another fact that catches my eye is of Brunei. It has only $0 external national debt. Can you imagine?

I can't?

After all these I can say that I am feeling ashamed of being a national of country with the highest external national debt. Are you?

We must not be as the debt is only 95% of our GDP, there are countries like Zimbabwe who has the debt almost 288% of their GDP. So we should not consider this debt as very bad, as we can pay back those debts whenever our economy comes out of the worst phase of economic downturn and moreover 25% of these debts are hold by foreigners, so the figure is not so bad after all. We should be united and not to panic. Instead we can try hard to make our country financially strong to shed the tag of the country with the highest external national debt.

Posted by

Jason

at

11:03 PM

2

comments

![]()

Labels: Debt

Tuesday, August 25, 2009

HOW TO LOWER THE COST OF YOUR HOME INSURANCE: GET SOME IDEAS

If you are determined to obtain a home insurance policy, remember some factors that may contribute in lessening the cost of it. A necessary home-insurance have probability to become at the same time expansive.

First of all, when it comes for restoration of your policy, go on searching the market to find an expert dealer. Often we close eyes to these details and pay heavily than we actually need to. Don’t just get into the former policy by renewing it. Try to find many low-priced alternatives. Well in doing so; be efficient enough to judge the best policy for you.

Secondly, being a net-savvy, it is easier for you to check all the policies online, thereby comparing other companies offering you cheaper investment.

The easiest way is to be honest to the company officials. This will at the same time save much money. Be honest enough to confess that you are alcoholic or a chain smoker; weather you have in home a burglar alarm or not. By stating these facts truthfully, you can save a lot of money on your payment.

The amount of surfeited cost that usually comes through it can also have some effect on lowering your premium cost. Trivial factors such as well-secured entrance or locality night watch schemes can be helpful in this regard.

Never let yourself be swayed by the tempting offers. Consider not only the cost of premium but also the kind of policy that you need to cover.

Posted by

Jason

at

7:17 AM

0

comments

![]()

Monday, August 24, 2009

HOME-INSURANCE : FOR TENANTS

You might have faced great difficulty dealing with home insurance, especially when you have applied as a tenant. Keeping in mind the crisis that we are now facing, there is an increasing volume of tenants, choosing to rent houses rather than buying it. This home-insurance, thereby, is becoming much easier, considering the present scenario.

You might have faced great difficulty dealing with home insurance, especially when you have applied as a tenant. Keeping in mind the crisis that we are now facing, there is an increasing volume of tenants, choosing to rent houses rather than buying it. This home-insurance, thereby, is becoming much easier, considering the present scenario.Along with other insurance industries (such as life insurance or car insurance), home insurance is on growing demand even among the tenants.

Obtaining a policy, is, always a better option especially for the fund you have deposited to the landlord and also the unexpected occurrences. Many companies have started regarding home insurance especially for tenants, as an advisable policy.

Before taking a decision, my advice is that you should start your own market research, so to say. IT IS ALSO NECESSARY THAT YOU SHOULD SEEK ADVICE TO A SPECIALIST IN TENANT POLICIES. IT IS CRUCIAL FOR YOU SHOULD BE IN THAT WAY AVOIDING PAYING HIGH OVER THE ODDS. Be sure to make your preferred area to be covered under the insurance, while renting the house.

When asked by the company officials, of what exactly you need to insure, remember that the house is not your property, but you are renting it for a certain period. SO YOUR PRIORITY SHOULD BE THE SUBSTANCE OF THE HOUSE RATHER THAN THE LAND. So don’t close eyes to small things, for all the elements consist the house.

Pay heed to rather small things such as the LCD TV or an expansive camera, to be insured under the policies. This may be confusing but don’t just get into a policy before viewing the entire contents of the policy. Because standard policies don’t include small details.

A tenant’s policy may range your properties from £3000 to £50,000. Maximum 6 persons could be included under the policy and outskirts of the house such as garages will be under the policy premium.

Don’t make a hasty decision before going for a policy. Think of your own benefits and consider every aspects of it.

Posted by

Jason

at

8:27 AM

0

comments

![]()

Labels: Insurance

Friday, August 21, 2009

SIMPLEST WAY TO BOOST CREDIT SCORE: USE YOUR CREDIT BALANCE

You are not closing any existing account, specially the older ones. You are supposed to hold a fund of more than 30-40 % of your present credit in a given month. You should be aware of the fact that if you do indict more, you should make some payment before your monthly credit card statement is available.

But at the same time you should need to maintain balance on those credit cards each month. Sounds confusing? You don’t have to maintain the fund and give interest. Well, it seems the best way to raise credit score, is to make use of it every month (could even be for small purchases); of course at the same time paying it off, before the report comes.

This means that you are handling your card intelligently and paying your bill on scheduled point in time. This seems of very little importance but this small factor has created a lot of problems for many people, who have tried to get a loan.

Remember poor credit score does not depend on holding a dime. Creditors often ignore this fact, which we tend to give unnecessary importance. What they want, is, that you pay their credits accordingly.

A little fund showing clear paying report proves much better than a huge amount, which remains unpaid. Isn’t it surprising that 35 % of your FICO gaining actually bases on your transparency in payment history? What matters is how you grip rather than how much.

Each month this good message goes to the credit bureaus. They consider the dollar figure.

It is important at the same time for paying big amounts before the repost comes. The statement, one can see, shows $5000 as your expanse, being paid full. They don’t see how many months it actually took. It looks so stunning without making you at all worried about large payment processes.

As I have earlier mentioned that your FICO score depends much on the maximum amount. It avails for you 30% of existing credit. Isn’t a big gaining in matter of credit scores?

If you are planning to use your credit for your desired purposes, start from this day your credit cards as a means for increasing credit scores.

Posted by

Jason

at

9:02 AM

4

comments

![]()

Labels: Credit

Thursday, August 20, 2009

HOW TO SAVE FOR A RAINY DAY: PERSONAL FINANCE GIVES YOU SOME BASICS

FIRST THING: TRY SAVING MONEY (NO MATTER WHAT AMOUNT IT IS) IN A BANK

In this way, you will end up saving cash in a bank, which will give you immediate right to use whenever it is necessary( that also with high interest rates).

Avoid paying taxes. And also go for a bank which provides you with a simple debit or bank transfer.

Don’t run for higher interest rates, for that could be risky.

Don’t spend your money in the stock and shares.

Try to keep in mind the primary purpose of saving money. You are saving money not for any high interest rates but for the sake of saving it. Having an easier access is more important than earning a bit more.

Don’t think of hoarding thousands, as your essential need lies in providing yourself with enough money to cover up your rainy day expanses.

NEVER USE YOUR CURRENT ACCOUNT TO WORK AS THE RAINY DAY FUND.

This accounts for several reasons. Your present bank account will make it too easy to make available for saving funds without letting you realizing it. And when you will need money, you will probably realize that you don’t have enough money to go for it.

Generally current accounts don’t compensate for high interest rates as savings accounts do. Avoid using it. Remember current account means for daily expanses, while savings account for the mere purpose of savings.

Be debt-free before going for a savings policy. Paying high rates of interests, while at the same time earning less from a savings policy, would be a foolish idea.

And now, when you are free from the past debts and unpaid sums, you can, in a state of peace, go on saving funds for a rainy day expanses.

Posted by

Jason

at

10:07 PM

0

comments

![]()

Labels: Money, Personal Finance

Wednesday, August 12, 2009

How And When To Refinance A Mortgage: Rule Of Thumb

Some of us must have been into nail biting and spending sleepless nights, invariably worrying of how to redefine a mortgage.

Some of us must have been into nail biting and spending sleepless nights, invariably worrying of how to redefine a mortgage.- Keep your worries aside.

I am giving you some suggestions as how and when to refinance rule of thumb.

- SELECT RIGHT TIME

We often use refinance home loan to pay off our stupendous debts, which we think help us in organizing our expenses and save funds for future or other purposes. But we should at the same time keep in mind the right hour to refinance as when it will bring us our desired benefits.

- LOWER INTEREST RATE

- REFINANCE WHEN YOU HAVE MONEY ENOUGH

- TRY TO KEEP PERMANENT RATE

- REFINANCE HOME LOAN WITH LOW-SCHEMES

When to refinance rule of thumb?. Simply when mortgage interest rates plunge below 6%.

Not only will it save you in monthly payments but also will hoard thousands of cash for you. Don’t get puzzled. Learn ways when to refinance rule of thumb.

1)Check if you have an changeable rate or a fixed rate in mortgage. When to refinance rule of thumb? This is the moment.

2) "When to refinance rule of thumb" while desperately craving, don’t act foolishly by choosing an improbable rate which doesn’t match with your original sum. By going for an adjustable rate you will not have the burden of paying high debts.

3) Find out the interest rate which is lower to your amount. Considering credit score the rate will be about 3%. Check online or call up the lenders for a similar quote.

4) Think rationally as of which to decide as your interest rate. Earning a good relationship with lenders would easily obtain you a perfect rate.

5) Now divide your total estimated amount by the monthly mortgage payment savings. You will find your required time. If it is longer than you estimated don’t go for it. If it is the longer than the time you are planning to spend in the house.It is the selection of your refinance rule of thumb.

Posted by

Jason

at

4:57 AM

1 comments

![]()

Labels: Mortgage

Saturday, August 8, 2009

The Credit Correction and Bad Credit

Today we live in the age of credit. Every financial institution is offering you credit in many ways like credit card and personal loan. Today no one can live without their credit. When your credit card crosses the credit limit then we can understand its value. But very few of us understand the credit and its future implications.

Today we live in the age of credit. Every financial institution is offering you credit in many ways like credit card and personal loan. Today no one can live without their credit. When your credit card crosses the credit limit then we can understand its value. But very few of us understand the credit and its future implications.Very few of us know about bad credit until they fall in the trap. We use our credit every where without thinking about its payment. When this indiscipline behavior touches the limit then we find ourselves in the bad credit. We seldom make the credit card payment and some makes the minimum payment of credit card instead of paying the full. Some skips the monthly payment of the loans and forget about our credit. But the credit history keeps track of all our behavior and adds bad reputation to our credit score. Then suddenly we find ourselves in the bad credit. At this time if we apply for a loan, we can find only the rejection. If anyone grants a loan then the interest rate will be so much high that it adds more black spots to our credit score. So its really important to keep a good credit score which can help you to get low interest credits in future.

But what to do if you are not able to keep your good credit and find yourself in bad credit. There is no reason to panic, there are ways how you can rectify your bad credit and re-establish your credit worthiness. The process is called credit correction.

There are hundreds of firms who claims to fix your credit and do the job of credit repairing. But there is also some strategies with whom you can make your credit score better by yourself. It is the best method to understand and control your credit by yourself because it’s your credit. You should follow the measures to repair the credit and re-establish your credit worthiness by yourself.

Posted by

Jason

at

9:51 PM

0

comments

![]()

Labels: Credit

Thursday, August 6, 2009

Credit Card Debt Consolidation: Some Basic Facts

Are you searching for a way that would resolve your credit card debt problems with an easy repayment program? In that case, credit card debt consolidation might be the solution that you are looking for. According to this program, all your outstanding credit card bills would be combined into one single bill. This means that rather than making payments for four separate bills per month, you are able to make one single payment per month. The most advantageous aspect of a credit card debt consolidation loan is that you only need to pay a nominal rate of interest. This article would provide some pertinent information on consolidation of credit card debt.

At the present time, getting a credit card is simply a matter of one or two clicks on your mouse. Every consumer wants to enjoy the advantages of money even prior to making payment. This is the cause why the majority of people are experiencing difficulties due to credit card debt. Subsequently, credit card debt consolidation becomes a requirement.

At the present time, getting a credit card is simply a matter of one or two clicks on your mouse. Every consumer wants to enjoy the advantages of money even prior to making payment. This is the cause why the majority of people are experiencing difficulties due to credit card debt. Subsequently, credit card debt consolidation becomes a requirement.A prominent disadvantage of credit cards is that if you carry forward your balance each month, you are likely to pay a higher rate of interest. In order to get your financial life under control, credit card debt consolidation can help you. In addition, it would assist you to restore your credit in the future.

Credit card debt consolidation helps you get rid of your credit card debt through formulating a suitable budget. You have to catalog your earnings and expenses. Try to maintain the expenditures as low as you can. You should firmly stick to this plan. Every advantage is offered to you against a reasonable price. You can look for credit card debt consolidation loans with the help of different online resources. By carrying out an online search, you would find countless lenders providing credit card debt consolidation loan quotes. Compare several quotes to get the most suitable deal.

Posted by

Jason

at

5:00 AM

1 comments

![]()

Sunday, August 2, 2009

Best Strategies to Control you Finances

Posted by

Jason

at

10:20 AM

1 comments

![]()

Labels: News

Wednesday, July 22, 2009

Federal Housing Tax Credit- Are you Confused about it?

We read in the news paper about the Federal Housing Tax Credit. They are saying this is helpful for the first time home buyers but very few people know how it can help us... So here is a video that is going to help you understanding the tax credit benefit and also federal housing policies for the first time home buyers.

Posted by

Jason

at

4:46 AM

0

comments

![]()

Labels: Credit, Mortgage, Personal Finance, Tax

Friday, July 17, 2009

Citigroup Makes $3 billion Profit in the Second Quarter

Citigroup has become 5th profit making large bank in the second quarter. It has made $3 billion profit in the second quarter. The market analysts had earlier predicted a huge loss in the quarter. The analysts had predicted that they are going to face 37 cents per share loss but in reality they have given profit of 49 cents per share.

Citigroup has become 5th profit making large bank in the second quarter. It has made $3 billion profit in the second quarter. The market analysts had earlier predicted a huge loss in the quarter. The analysts had predicted that they are going to face 37 cents per share loss but in reality they have given profit of 49 cents per share.In 2008 second quarter it has faced loss of $2.86 billion. The bank recently made profit of $6.7 billion after selling its majority stake at Smith Barney brokerage unit. The value of its some assets also recovered their older value of pre recession time.

This bank was considered as worst hit bank by the recession and credit crisis. The government has already given some fund as stimulus to it and the fund is now working wonder.

Posted by

Jason

at

9:53 AM

0

comments

![]()

Labels: News, Personal Finance, Recession

Tuesday, July 7, 2009

Monday, June 22, 2009

Buying Life Insurance

According to WIKIPEDIA

Life insurance or life assurance is a contract between the policy owner and the insurer, where the insurer agrees to pay a sum of money upon the occurrence of the insured individual's or individuals' death or other event, such as terminal illness or critical illness. In return, the policy owner agrees to pay a stipulated amount called a premium at regular intervals or in lump sums. There may be designs in some countries where bills and death expenses plus catering for after funeral expenses should be included in Policy Premium. In the United States, the predominant form simply specifies a lump sum to be paid on the insured's demise.

Many people have the preconceived notion that life insurance is simple, and that all insurance companies will propose alike products. This couldn't be further from the truth. The prices of your premium depend on your age, gender and fitness, and some companies undertake prolonged procedure to make sure the information you have specified is accurate. The standard monthly payment for a man say of 35 who is a non-smoker is £15. The monthly premium would boost to at least £30 if the man becomes 40. Smoking can make it a bit up.

There are ample of life insurance policies on the marketplace, so it is vital to investigate all the offers so you obtain the finest deal. A concession broker will present you a better deal, as they go through any payment they get to the customer by turning their monthly payments cheaper. The broker will allege a little one-off fee (usually about £30), but this is petite contrasted to what you may put aside with inexpensive monthly payments over the term of your payment.

When looking for any such manufactured goods, use an insurance comparison means to make it certain that you have a good view of market. Low-priced life insurance is easily accessible if you get to know where to look. Life insurance and term assurance are accepted products, so take benefit of the competition of insurance companies.

Posted by

Jason

at

7:18 AM

4

comments

![]()

Labels: Insurance

Friday, June 5, 2009

Ideas to maintain a Food Budget

Since financial planning is a means of life for most public today we are time and again looking for ways to hoard cash. Consumers are finding knowledgeable ways to store including eating at home, with coupons, probing for deals and shopping restricted. Cost of the whole lot seems to have become greater than before, together with stuffs such as milk, sugar, wheat and corn. Of course, this grounds for a swelling result and we see score -ups on bread, baked goods, meat and everything made with high-fructose corn syrup (not that you would include those unwholesome foodstuffs in your meal anyway, right?).

Since financial planning is a means of life for most public today we are time and again looking for ways to hoard cash. Consumers are finding knowledgeable ways to store including eating at home, with coupons, probing for deals and shopping restricted. Cost of the whole lot seems to have become greater than before, together with stuffs such as milk, sugar, wheat and corn. Of course, this grounds for a swelling result and we see score -ups on bread, baked goods, meat and everything made with high-fructose corn syrup (not that you would include those unwholesome foodstuffs in your meal anyway, right?).Today's extravagant grocery prices simply give you encouragement to endeavor new thoughts and draw out your wallet. Pull off those old cookbooks. There are plenty immense ideas stocked up in those pages. What about taco night? Big salads. Or be inventive with pasta bakes. Pasta is economical (particularly if you formulate your own sauce and can loose ends). You can on the whole toss anything in your plate from meat to spinach or mushrooms. Just search your fridge and set off to town. You are the master cook there.

To locate weekly specials or unique offers verify your mailers, grocery brochures or local contract web sites that mark specials for the recipes you have chosen. You can make remarkable recipes from your answers that will compose hanging about with an oldie home-cooked food and say an enjoyable movie There are all the time a range of thoughts that are easy to get ready and their exploration capacity can aid you discover fresh customs to arrange the food you can boast off or that is on retailing that week.

Shopping narrow is another incredible means to hoard. Not only is local food very fresh and loaded with more nutrients, but it's typically less expensive. You can discover astounding and yummy fruits, vegetables, nuts, honey, jams and meat. Visit your neighboring Farmer's Markets or stores like Whole Foods that endorse home grocers. You will accumulate money, be indulgent to extra palatable foods, and you will uphold affluence in your society.

So, what are you waiting for? It will make all the distinction. build a daily list of options, look for contracts and offers, attach to your grocery file, buy local and you will put aside money. Not to talk about you will have the chance to guide your inner cook, include more worth time in the kitchen with the folks and children and rouse the confined market by shopping in the neighborhood. Give it a thought.

Posted by

Jason

at

6:37 AM

4

comments

![]()

Labels: Budget

Friday, May 29, 2009

Get Mortgage Even with a Bad Credit Score

The foremost thing you should be familiar with when you attempt to get a new house is that your credit score has to be a fine rating for the financial institutes to provide you with the money you need. Even if you have a bad score. Don’t worry just lift up your score with the bureaus.

The foremost thing you should be familiar with when you attempt to get a new house is that your credit score has to be a fine rating for the financial institutes to provide you with the money you need. Even if you have a bad score. Don’t worry just lift up your score with the bureaus.It is very much necessary to have a good score because otherwise it will become difficult to get loan form a good bank. For getting this, your score should be between 640 and 620.

If you have forgotten to match up with the bureaus, there are ways to make your rank qualify home loan financial help.

Firstly, take out quality time to find out the essentials and procedure of putting your details in a good figure. This will not cost you money but it will involve much effort from your part in writing the argument and legalization letters that will be mandatory by the bureaus and collectors so as to rearrange your report in a good health.

Secondly go and get some repair agency to do this task for you. And you pay them accordingly.

Posted by

Jason

at

5:05 AM

0

comments

![]()

Sunday, May 24, 2009

Bankruptcy Substitute Ways

People in deep economic nuisances, see bankruptcy as a solution to their problems.

But they should be informed, especially clients facing financial troubles, that there are bankruptcy alternatives which will help them to get out of this chaotic situation.

The reason behind bankruptcy is usually the fact that it is capable of retaining certain types of properties. A further way that a debtor can resolve his debts is by remaining inert , paying no heed to activities. This is possible for individuals having no certain private property; or people who are jobless or be retired, with no secure earnings. And the legal action proves a failure in their case, as the creditors give up every hope of collecting nothing from them..

All they have to do, is to wait for some years, watching their debts evaporating from the credit history.

Another very effective way is, to manage money-spending. Usually debtors waste more money much more than they earn. They should reduce areas of expenses so that at the end of the day they stay with extra notes.

They can do a lot of things which can decrease their expenditure like having a low-priced yet healthy food or spending less for entertainment or using a public transportation.

Debtors can reconcile with the creditors as the creditors also know that this way they will get if not the entire but at least some portion of his money back, which otherwise seems impossible.

This alternative is only for debtors who owe steady wages and remained with at some properties.

In case of an organization or partnership, having bankruptcy, can consult with the debtors to reconstruct their debts. This will help them to reduce their debts.

Thus it is clear that this alternative ways are much better than bankruptcy. For this the debtors should discuss with the creditors, banks and others. These alternatives are certainly much better way to face the crisis.

Posted by

Jason

at

9:26 AM

0

comments

![]()

Labels: bankruptcy

Friday, April 17, 2009

Insurance Industry in US

The ongoing financial turmoil in the US has affected the insurance sector in the country. This has led to bearish sentiments among investors. Experts are of the opinion that this trend is likely to spill over in the year 2009 too. The insurance industry in the US is regulated at the state level and the federal level. Significant drop in investment income has resulted due to troubled equity and credit markets. The insurance industry in US has taken a backseat due to several factors. Some of the prominent factors include

The ongoing financial turmoil in the US has affected the insurance sector in the country. This has led to bearish sentiments among investors. Experts are of the opinion that this trend is likely to spill over in the year 2009 too. The insurance industry in the US is regulated at the state level and the federal level. Significant drop in investment income has resulted due to troubled equity and credit markets. The insurance industry in US has taken a backseat due to several factors. Some of the prominent factors include• Unpredictable market movements

• Rising cost of health care

• Probable political upheavals

• Natural calamities, etc.

During such troubled times it is essential for you to equip yourself with the appropriate insurance coverage so that you can withstand the turbulent conditions. There are a number of ways in which insurance help can work wonders.

There are two ways in which you can buy an insurance policy for yourself. You can either get complete information from an insurance expert. He can also suggest policies that will serve your purpose. Alternatively, you can shop around offline as well as online for different kinds of insurance help.

Some of the insurance policies and plans that may help you in times of trouble include the following-

• Health care insurance

Health care insurance bears your health costs and your medical bills when you fall sick. A standard health insurance plan will cover all expenses starting form pre hospitalization to post hospitalization.

• Home insurance

Investing in your home can be an investment of a lifetime. Protect your investment by selecting the right type of home insurance policy.

• Auto insurance

Auto insurance has been made compulsory in most of the states in United States. Damages caused due to accidental car crash or even a minor scratch gets compensated if you own an auto insurance policy.

• Life insurance

Losing the sole bread earner to some unforeseen incident can cause a lot of mental agony. A life insurance plan can help the family of the deceased to restore earnings of the household.

• Disability insurance

Disability insurance helps you to replace your family income if for certain unforeseen incidents you lose the ability to work and become disabled.

With so many options of insurance help available, you can choose a plan that will suit your financial needs best.

Posted by

Jason

at

11:48 PM

0

comments

![]()

Labels: Insurance

Sunday, March 29, 2009

Be Bold To Make The Credit Clean Up

Credit cards succeed in being manipulative, and, if you’re late with your monthly sum, can be very mean.

Credit cards succeed in being manipulative, and, if you’re late with your monthly sum, can be very mean.

And when you are going through a hard time, those people don’t want to hear any excuses in case of non-payment. As a result your APR tumbles down. Now you have to give them APR of 15%, and sometimes, upwards of 20%. Come out of this nightmare.

Contented enough of bullying they surrender to the demand of the credit card company. It is essential to have a ‘FAIR’ credit report.

You should have guts enough to come out of this dreadful situation.

The one option that all agreed upon is to go for a card with a lower interest rate that you will use to transfer your entire balance to your previous creditor company. Just be polite and ask them to allow you a few weeks. And once to find them, go to the previous creditor company to make reconciliation and give you a better deal by lowering the interest rates.

Thus instead of being a slave to them, be your own boss. Go and fix your credit plans yourself and make a fair credit clean up.

Permitting yourself the choice of transferring your business elsewhere, you're uttering in no vague provisions that you aren't happy with their approach to you, who, outside of losing one or two payments, has compensated at least the monthly bare minimum time and again, and they should be try to assist you in the tough times you're existing in, instead of punishing you.

Lexington Law is helping the debtors to get out of this credit card companies and make people saved from bankruptcy.

Posted by

Jason

at

5:11 AM

0

comments

![]()

Labels: Credit